Adnan Chowdhury,

UK Policy & Campaigns Manager at Wise, UK

“The Transparency Task Force works tirelessly to ensure consumers are treated fairly…. by the finance sector. It hosts engaging events throughout the year, bringing together industry and thought leaders to help promote transparency and modernise global finance. All this will ultimately benefit consumers and our customers, and we are proud to be an Ambassador of the TTF.”

Adrian Tupper,

Counsellor, Adrian Tupper

“I became involved with the TTF after leaving the financial services sector, where for 30 years I developed indices and passive funds. I had already created my MoneyQuestioner.co.uk blog and was taking a holistic look at the financial ecosystems that define the sector, from money creation to business practice to social impact. TTF was already well down that same trajectory and, with Andy’s insatiable enthusiasm, I very soon attended events whenever I was in London.

I have watched the TTF snowball from meet-ups of interested professionals to meetings involving regulators, campaigners and Members of Parliament. And …it’s inspiring to see how the TTF is really effecting change so that the sector moves to serve the interests of its consumers.. rather than simply talking about it. Unavoidably moving to Zoom last year has probably made these meetings easier for many people – me anyway – and I had no hesitation committing to an annual subscription.”

Aivars Lode,

Chairman, IT Capital

“Having identified how markets are manipulated resulting in the common man losing, I applaud the work being driven and completed by Andy and the members of the Transparency Task Force.”

Alan Easter,

Business/Management Consultant, 2nd Week

“Be it banking, investments, tax wrappers or the simplest of savings accounts, our industry cannot help itself building complexity and complication. As society develops and grows, and self-provision becomes more necessary, anything that encourages individuals to engage should be supported and promoted

The work that the Transparency Task Force, ably led by Andy, with such a small amount of resources and budget, needs to be applauded. As the last year has taught us, none of us truly know what is just around the corner, and whether encouraging pension saving, buying insurance or just putting by a small nest egg, whatever the solution may be, more of it is required. Only by creating trust will consumers engage more, and transparency and simplicity are by far the two most important battlegrounds.”

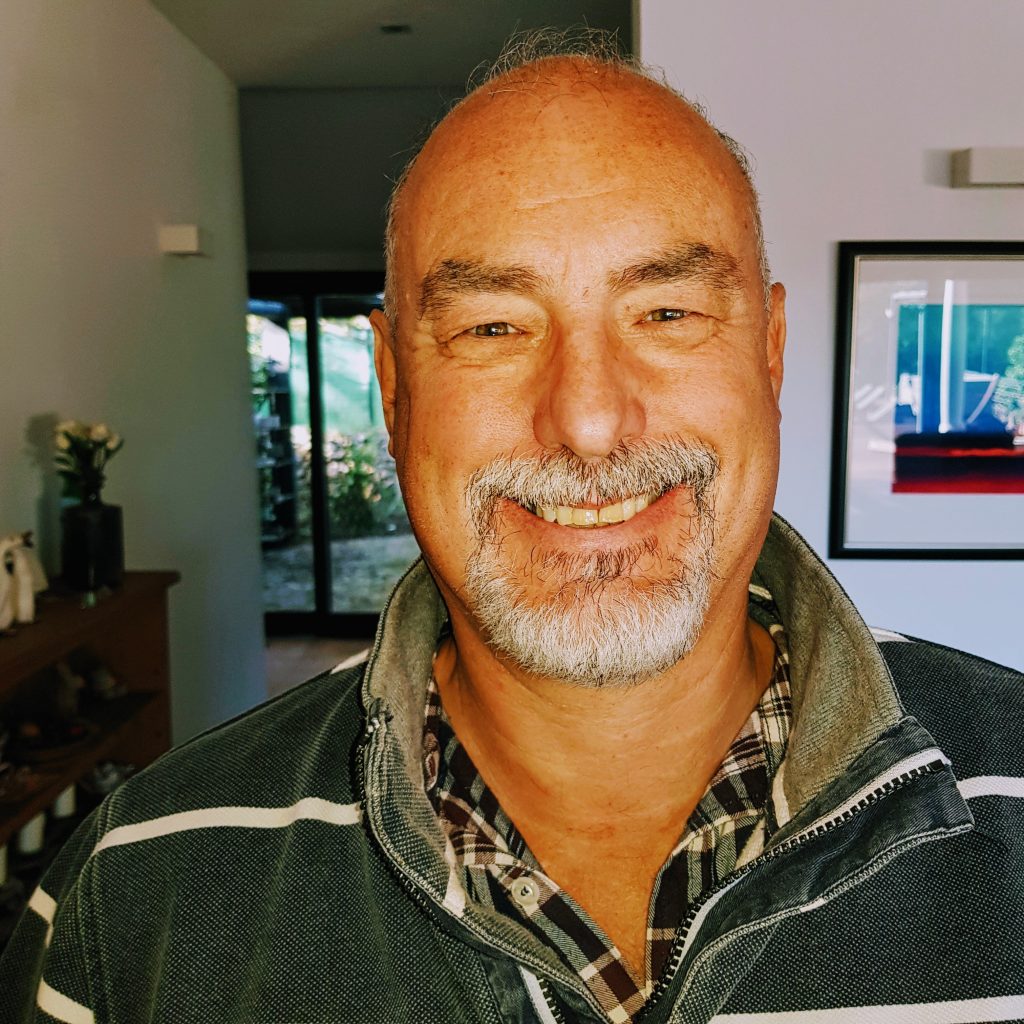

Alan Rayner,

Manager, Bath Bio Art

“My support for the work of TTF comes not from any particular financial standpoint or expertise, but more fundamentally from natural and moral philosophy. An awareness of how we human beings naturally are as needful living creatures enables us to value honesty, reasonableness and kindness as vital qualities of loving care for self and neighbourhood.

What causes us, on the other hand, to be selfishly deceitful, unreasonable and cruel is the product of a profound misconception of reality, which isolates or conflates human identity from or with the remainder of nature. This misconception has been built in to economic systems founded on exclusive self- or group-interest. It results in societal mistrust, dysfunction and iniquity. By highlighting examples of dishonest practice in the financial sector, TTF both draws attention to this problem and points the way towards its resolution.”

Alan Williams,

Director, Servicebrand Global/UK Values Alliance

“There cannot be many movements which are more worthy, needed and valuable than Transparency Task Force (TTF). The fundamental driver is to see fairness in the financial services sector by promoting ongoing reform. In the new paradigm I refer to as the Values Economy, successful organisations of the future will establish a sense of shared values across stakeholder groups (customers, employees, service partners, local communities etc). TTF’s work in striving to achieve transparency and integrity in a sector which is at the heart of the global economy is therefore timely and critical for sustained performance globally. The alternative could be a level of business failure to make the Enron and Lehman Brothers failures seem trifling by comparison.

I am in awe of the level of commitment, collaboration and output achieved by this group under the inspiring leadership of Andy Agathangelou. All power to TTF for its future efforts in championing fairness for financial services customers all over the world.”

Aleksandra Maczynska,

Executive Director, Better Finance

“BETTER FINANCE is proud to continuously connect with The Transparency Task Force (TTF). TTF is an associate member of our Federation and remains an inspiring driver for much-needed reforms of the financial services sector with an impressive track record. BETTER FINANCE has been regularly speaking at the TTF symposia – an initiative unique in its inclusiveness of stakeholders and in leading the most up-to-date exchanges on the way to shape the future of transparency. These seminars are a hub that fosters a positive and progressive change in the financial sector.

BETTER FINANCE can unreservedly state that TTF promotes and enacts best practices within its network, while acting as a pragmatic actor to build the tools that will strengthen consumer protection. This has the potential to set in motion large-scale political and industrial changes.

Promoting transparency and reforms in the financial sector represent the two key values which we share and are proud to support and cooperate with TTF in order to “ensure consumers are treated fairly by the finance sector.”

Awaiting photo

Alison Johnson,

“It is so welcome and refreshing , to receive regular updates and invitations to participate , in the invaluable work that Andy Agathangelou and his hard- working and excellent team at TTF undertake. We are all fighting hard against fraud and the corruption and cover – up by authorities, regarding the processes and events which led to, in many of our cases, a catastrophic and hugely damaging and traumatic sequence of events and outcomes, outside of our control at the time and engineered by some creative and woefully crooked fraudsters.

The financial sector, as a whole, particularly in the unregulated lending sector, needs a thorough overhaul and proper regulation and it is the, largely unsung, efforts, by people such as Andy Agathangelou and his team at TTF, in addition to all of us who continue to fight to expose the fraudulent wrongdoings in our individual cases, which are, baby step by baby step, bringing about awareness of such fraudulent practices and hopefully an imminent sea change in the financial sector as a whole. Justice and principles in lending and not smash and grab by thoroughly greedy and dishonest bankers and their associates, is what TTF and all of us as individuals are working to achieve”

Allan Grody,

Principal, Financial Intergroup

“Of all the activities associated with the mission of the Transparency Task Force (TTF) for making society better is that of improving the financial services sector’s infrastructure – little understood yet critical to enabling all other reforms. And at the heart of infrastructure is data – electronic data that flows through networks and into and out of computers. That this data is not standardized – hundreds of different ways to identify the same product, person or trade counterparty; and hundreds of different ways to transmit this data within the networks that constitute the global financial system.

This problem was first recognized by regulators during the financial crisis of 2008. This lack of data standards made it impossible to view an aggregated picture of risk building up across the financial system. It also was imposing a significant cost burden on the industry to maintain duplicate data bases with different data definitions and multiple transmission protocols. This required imposing an additional costly layer of mapping software to interoperate amongst thousands of financial intermediaries, hundreds of financial infrastructure entities and thousands of data vendors. Ultimately the industry overtime passes these excess costs onto society in the form of higher product costs.

The G20 took up these issues in its gathering in 2009. It approved an initiative to improve financial stability by creating more transparency in the financial services sector. The first step was to establish data standards for a more timely and granular view of financial transactions submitted to regulators.

Since then, the industry and its regulators have accomplished much but much more needs to be done. Toward this end, the TTF has stepped in to assemble a small expert group seeking new ideas to accelerate and improve upon earlier work. As a member of this group I hope we can make significant progress toward further refinements in existing implementation plans.”

Allan Mendelowitz,

President, Actus Financial Research Foundation

“The role of financial institutions and markets is to serve the needs of the real economy. When done correctly finance contributes to economic growth and economic efficiency. However, in recent decades finance, as a share of GDP, has grown all out of proportion for that role. This distortion has been enabled by financial market opacity and misaligned incentives. I have found the Transparency Task Force to be an important and influential coalition of like-minded and knowledgeable citizens committed to financial reform in order to more effectively and fairly serve the needs of society.”

Andrew Mills,

Director, Insight Financial Research

“The TTF is a unique grassroots body fired with the determination to make finance work better for society. They are a diverse and energised group motivated by the best of intentions, and working with them in any capacity is always rewarding. It’s a delight to be associated with such people and a great pleasure to support the TTF’s work.”

Andrew Clare,

Professor of Asset Management, Cass Business School

“The work of the TTF has been crucial in highlighting the need for greater transparency in all parts of the financial services sector, shining a light on those areas of the sector that have for too long been shrouded in shadow. The Task Force has gathered around it some important voices from the financial sector and, with their help, and with a single-minded focus on the prize of improving the sector’s performance for all, has achieved a great deal. I am certain that the Task Force will continue to champion the cause of financial sector transparency for all, and will continue to be a leader in this regard.”

Andrew Delmont,

“I am very proud to be a South African ambassador to the Transparency Task Force. The work that TTF does to improve and encourage transparency is vital to the smooth functioning of the industry through improving trust between consumers, advisers, providers and regulators”.

Dr Andy Schmulow,

Senior Lecturer in Law, The University of Wollongong; Secretariat member: All Parliamentary Group for Personal Banking and Fairer Financial Services, House of Commons House of Lords

“It has been a pleasure and a privilege to encounter an organisation as purposeful as TTF. Through its activities it is making a meaningful and demonstrable contribution to efforts around the world to ensure that the financial industry serves society, not the other way round. To that end I am especially impressed by its activities to hold to account those institutions charged with enforcing the law and upholding the public interest. I am grateful for the insights that TTF’s selfless, dedicated leadership have provided to pursuing these goals in Australia; and for the opportunities they have provided for us to share Australia’s experiences with a wider audience. I commend the work that TTF does wholeheartedly, and I hope, for the sake of all of us who interact with the financial industry, that TTF will grow stronger and become ever more influential in these important debates.”

Anna Tilba,

Associate Professor in Strategy and Governance, Durham University Business School

“As a scholar in governance, I believe in developing knowledge that provides answers to social problems not only through pure academic research, but also through collaboration between various stakeholders. I also believe in making that knowledge accessible to relevant stakeholders such as industry practitioners, regulators and policy makers. The Transparency Task Force is a particularly good example of productive, influential and longstanding knowledge creation, dissemination and action. TTF is a collaborative, campaigning community dedicated to driving up the levels of transparency in financial services, both in the UK and across the world. TTF’s vision is to “build a highly respected, influential and international institution that is dedicated to helping ensure consumers are treated fairly by the finance sector”. By bringing various stakeholders together and working on action-driven agenda, TTF is able to not only highlight the ‘wicked problems’ within financial services but also do something meaningful about them.”

Annemarie Borg,

Founder and Director/Performance Coach and Speaker, Antara Project

“As an ambassador of the Transparency Task Force for the last two years I sincerely want to express my full support for the important work the whole team at the Transparency Task Force and its supporters are committed to in bringing the financial sector as well as the business sector to realise that the public has a right to expect to be treated with fairness. We should have a financial sector living up to the principle “as if people mattered”.

Our economy can only thrive with the backing of a healthy Financial system encouraging the business sector to be transparent and act ethically, so as to build trust in the community. This is the change we have been looking for in the last 20 years, and it is the right time to put down some solid foundations. Too often do we still hear of abusive practices leaving people feeling helpless or worst even desperate. One of the ways to achieve this change is to hold the financial sector and the business sector to account.

To actively promote Violation Tracker is a way forward we should not miss out on. It is a tool for change as it exposes the practices than any company or business will want to avoid, and encourages new businesses to align themselves with new practices which will serve the public interest better.”

Atanu Saha,

Scam victim – Collatera, Wellesley, MoneyThing, Funding Secure

“The Transparency Task Force (TTF) has been doing sterling work in ensuring the need for full transparency & accountability in the financial sector and it is working tirelessly to expose bad practices and raise public awareness of the issues.

They are the only institution to champion the cause of the ordinary people, effectively trying to rectify some of the unfair practices of the financial sector, including the shortcomings of the Financial Conduct Authority and the Financial Ombudsman Service. TTF is working hard to convert the sector from a loot & plunder industry, to one that is more equitable for all, in the larger interest of the Society.

TTF is positively influencing policymaking through engaging with Parliamentarians by highlighting the plight of the victims of the financial crime.”

Bart Naylor,

Financial Policy Advocate, Independant

“Transparency Task Force’s ambitions span the globe of financial problems. Given the power of finance over the real economy, help from all sectors is needed to shape policy that serves average citizens.”

Blake Goud,

CEO, RFI Foundation

“The Transparency Task Force has a strong ability to convene a wide range of perspectives from among those interested in changing the way the financial sector works, and how it delivers what society needs in a fair way. I have found good opportunity to connect and network with other similarly minded people through the TTF’s events and regional calls.”

Bob Lyddon,

Owner, Lyddon Consulting

“Transparency Task Force is achieving critical mass in gaining attention as a voice for the ethically-concerned section of the financial industry and, through that, as a voice of the customer, able to articulate the many problems and concerns into the right channels and in a convincing way.”

Awaiting photo

Boz Michalowska,

Head of Consumer Law & Product Safety Development, Leigh Day

“My work on the collapse of the Woodford Equity Income Fund has exposed me to the terrible loss that investors have suffered and to their lack of consideration by financial institutions. It is vital now more than ever that the Financial sector is called to account. The Transparency Task Forces’ work is pivotal in educating, exposing and interrogating the status quo.”

Brenda Sullivan,

Insights and Sustainability

“From my earliest knowledge of the Transparency Task Force, with its championing of ethical behaviours and concern for sustainable practices, I have been impressed with the sincerity and purpose of the TTF and its people. There are few places where the expertise from people who have worked inside the system are making it better for all. TTF is one such place. Its deep knowledge of business and its high standards for ethics make TTF a powerful force for good, not only in the UK but in many countries across the globe.

The knowledge and support found in the TTF have helped me to effectively challenge a large bank for unfair treatment. TTF has my support, a place where I now volunteer my skills to help drive positive changes and access to fairer finance. It is invaluable to know that there is an organisation on the side of right like the Transparency Task Force.”

Brian Radbone,

Head of Technical, Transact

“The challenge for investors looking for the best way to build up and look after their accumulated wealth and plan for the future is very challenging in the complex financial services sector where a multitude of options are available. Unfortunately, such complexity has led to investors being taken advantage of and suffering considerable financial loss.

Whilst there are regulatory safeguards, these are often insufficient in providing investors with the necessary protection from unscrupulous operators. This is where the TTF has been so important and effective in raising and pursuing the ongoing need for greater accountability in the industry, giving increased security and comfort to investors while helping drive the need within the industry to ensure higher levels of integrity and delivery. Their influence with the relevant authorities means that the TTF can help bring about the changes needed to achieve these aims.”

Carlos Panksep,

Managing Director, Cefex

“TTF offers a thought-provoking forum for the exchange of views and opinions of the global financial sector. Its mission is well communicated through written materials and live meetings. The TTF has helped me gain a broader understanding of the issues affecting the investment community by hearing from international speakers with diverse backgrounds. It’s rewarding to learn how many of us experience common issues. From my own organization whose goal is to promote best practices for fiduciaries, I encourage the efforts of the TTF.”

Charles Fowler,

Chair, World Values Day/UK Values Alliance

“Having lived and breathed the financial services sector for around 30 years or so, I have immense admiration for its dynamism, its creativity, and its huge contribution to the economy of the UK and the rest of the world. It makes the wheels of our society turn and we can’t do without it. However, like any other sphere of human activity, problems and abuses can spring up. The very dynamism which makes it so quick to adapt to changing needs and conditions, can also throw up malignant mutations which spread fast and do a lot of damage if not spotted and rapidly contained. So often the worst damage is suffered by individual consumers who lack the resources to protect themselves or find redress. That’s why I wholeheartedly support the work that Transparency Task Force (TTF) do so effectively.

In six action-packed years it has become a vigilant watchdog, constantly scanning the sector and loudly raising the alarm when trouble is seen. In doing so, it has become a leading proponent of much-needed reforms to the system, particularly the regulatory aspects. The more transparent the sector is, the easier it is to spot problems before they can do too much damage, and TTF’s work has been invaluable in improving the sector’s visibility and making ever the need for reform in certain areas ever clearer. The recent development of the Violation Tracker UK provides a great example of TTF’s energy and innovation. By combining the violation date from the Financial Conduct Authority, the Employment Tribunal, the Pensions Regulator, the Bank of England, the Prudential Regulatory Authority, the Health and Safety Executive, HM Revenue and Customs, the Environment Agency, the Competition and Markets Authority, the Serious Fraud Office and over 40 more UK-based entities, it gives professionals, legislators and the wider public instant and accurate information about where and how trouble is brewing.

What an amazing public service. Long may the Transparency Task Force thrive and grow!”

Charlotte O’Leary

CEO, Pensions for Purpose

“The Transparency Task Force proves time and time again why they are so progressive, needed and valuable to the finance industry. From tackling structural changes in the finance industry to highlighting scandals, loopholes and barriers to entry, TTF is at the forefront of financial service transformation. But the job is not done and transparency is needed everywhere to empower asset owners, clients and society with the tools and information they need to dismantle the impenetrable language, products, services and incentive structures that continue to create barriers.”

Chet Gladkowski,

Customer Development, GoKnown

“As technology continues to collect more and more information, overshadowing our transactions and personal lives, the Transparency Task Force is an absolutely vital and necessary organization. Their clarion call for transparency, coupled with an examination of what data is collected, how information is used, plus continual calls for accountability, put them at the forefront of life and business in the 21st century. For every business or individual that uses a mobile phone, searches for and purchases things electronically, or shares information via the internet, the Transparency Task Force is fighting for and defending you, your organization, and most importantly, your data.”

Chris Tobe,

Investment Consultant, Stable Value Consultants

“Transparency Task Force is a unique and critical organization greatly needed for the future of financial services”

Chris Riley,

Mortgage Malfeasance Whistleblower

“I’ve been involved with The Transparency Taskforce a relatively short time.

I continue to be inspired by their dogged determination, in particular asking the seemingly awkward questions most of us would like to raise but lack either the platform or medium to do so.

I applaud TTF in their efforts and look forward to supporting Andy Agathangelou and his team in the coming months and years.”

Con Keating,

Head of Research, BrightonRock Group

“As one of the initiators of the TTF I have been delighted and surprised by the extent of its success. It has moved the Overton window and transparency is now the accepted norm with open debate permitted on almost all aspects of financial services, including such previously taboo subjects such as investment management costs and fees and ‘greenwashing’. The TTF’s engagement with regulators and supervisors across the financial services piste seems to be an important part of a future where regulation will only grow in significance.”

Craig Beevers

“I have worked at a senior level in financial services for over 30 years, and been an expert witness on cases involving many of the largest and arguably worst abuses of the global financial system, including LIBOR rigging, metals market abuse and FX market fixes. One of the striking features of all these abuses is that they did not rely on anything new. The techniques that enabled them had been in use in some cases for decades, and yet regulators had failed to spot them in time to prevent losses or in many cases at all, time and time again.

The need for change is undeniable. Regulators do not appear to be fit for purpose. Fines imposed in the UK on the rare occasion that wrongdoing by a major institution is detected are pitiful – they are simply a worthwhile cost of doing illicit but profitable business. Whilst this state of affairs continues, there is no reason for bad actors to change their ways. Against this background the Transparency Task Force is to be applauded. It is the only truly independent consumer body holding financial services providers to account and working to expose bad practice.”

Darren McShane,

Specialist Financial Regulator Consultant

“I have been an observer, and at times an active participant, in the growth of the TTF over the past few years. The TTF is emerging as a powerful voice for consumers of financial services across a number of jurisdictions. It is encouraging to see the TTF step forward in this role, giving consumers a stronger voice in the face of a powerful financial services industry.

The TTF also provides a range of events which are an exceptional opportunity for discussion, debate and the development of thought leadership. Unlike many of the self reinforcing bubbles that we all, inevitably, operate within these days, TTF events bring together a range of participants from different backgrounds and perspectives. This provides a fertile opportunity for vigorous discussion and debate that can challenge pre-existing assumptions about a range of issues including acceptable conduct within financial services firms.”

David Llewellyn

Professor of Money & Banking at University of Loughborough

“As finance becomes ever more complex with the potential scope for consumers to make bad decisions in the purchase of financial products and services, the need for full transparency with respect to financial firms and their products and services has never been greater. .If consumers of financial services are to be able to make rational and appropriate choices in the financial products and services they buy, it is essential that they have trust and confidence in the suppliers of financial services. For this to be possible, consumers and all users of financial services and products need all relevant information about the firms they are dealing with and the products and services they are providing.

Through its webinars, conferences, publications, parliamentary and other lobbying, the Transparency Task Force performs an invaluable role in emphasising the need for full transparency and raising public awareness of the need for greater transparency and accountability of financial firms. It brings together a wide range of expertise and perspectives from many countries. The conferences and webinars offer participants the opportunity to appreciate a range of perspectives and to contribute to important debates on all issues related to transparency in finance. It provides a valuable forum to identify and discuss why transparency is important and how it should and could be enhanced.”

David Pitt-Watson,

Consultant, London Business School

“Finance, like any other industry, is there to serve others. That is what the Transparency Task Force aims to ensure. It started by demanding that people should know how much they are being charged for the management of their pensions and investment. That ‘sunlight is the best disinfectant’ in addressing the all-too-common overcharging. Markets won’t work if the customer doesn’t know how much they are being charged. That is where the TTF started, and it does not reflect well on the finance industry that despite progress, the TTF’s campaign is not yet finished.

But finance also requires integrity. Customers need to know that those who sell them products do so in good faith. Thus the campaigns to address pension scams which have blighted thousands of people’s lives. The aim is an effective finance industry. One which serves others, and can only profit if it does so.”

David Rankin,

Managing Director, Punter Southall Analytics

“The lack of transparency and increasing levels of asymmetry in global financial services markets are ongoing problems that can only lead to poor and/or unintended outcomes for consumers. To their credit, the TTF does not shy away from tackling the core issues that impact the financial well-being of those who place their trust in financial services. The TTF Symposia are extremely informative, the topics are current and of high interest to any financial services professional.

The Credit Crunch of 2008, Brexit and now the COVID-19 pandemic have only served to further the dislocation between financial services firms and their customers. The TTF is needed now more than ever and the recent initiative in setting up an All Party Parliamentary Group on Pension Scams in the UK is timely and shows the desire and power of the TTF to effect positive change. The TTF is, and has been, one of the best industry groups globally for effecting serious change in financial services markets. Long may it continue!”

Diane Weitz,

Director, Ashlea Financial Planning

“I joined the Transparency Taskforce close to its inauguration. Having been a member of the Connaught Action Group which was set up to try to get compensation for clients who had invested in the Connaught Guaranteed Low Risk Income fund which turned out to be none of those things. One of the frustrations of being a Financial Adviser is that the FCA seems to be unaccountable to anybody and their failings in acting on information provided about this fund have now been confirmed by the damning ‘Gloster Report’. The Taskforce has managed to get together a group of very influential people who are able to keep the issues of failure of regulation and corruption in large institutions under constant review. Andy has managed to build up connections with Members of Parliament and provides evidence, on aspects of the problems occurring in Financial Services, to several of All Party Parliamentary Groups. This lobbying should at least keep these problems in the public domain and avoid them being pushed under the carpet.

The group now has a global reach which extends to the US and Australia. Its independence should enable it to continue to agitate the relevant bodies to meet their obligations. One of the FCA’s main purposes is to Protect the Consumer. Changes need to be made to its governance, and tardiness to react when provided with evidence of consumer detriment, to enable it to meet this laudable aim. I hope that the Group will grow and become a real contender in holding those who have the power to make improvements to the status quo to account.”

Dhruvin Patel,

Quantitative Trader, Mathisys Advisors

“TTF is an emerging institute that has a strong focus on finance discipline across various sub sectors. It puts high focus on awareness of recent finance related issues, and also puts efforts on coming up with solutions. It was interesting to know that they are using various Game theory frameworks in tackling problems. It has a diverse set of people who participate in various meetings coming from different backgrounds. It also has a network of PHDs / researchers participating in these activities. I look forward to participating in its efforts in the coming future.”

Diane Bentley,

Highthorn Holiday Accommodation

“Both myself and my husband are relatively new members of The Transparency Task Force and have been inspired by the core beliefs and principles of the group – especially how like-minded individuals can come together to make positive reforms to a financial sector that has lost the trust of its clients. The volunteers in the group have far reaching skills and knowledge that are starting to be listened to by the people that count. We truly believe we are already making an impact and this will continue to develop on both the UK and world-wide stage

Whilst this work should be undertaken by the government of the day, there has always been a ‘laissez faire’ attitude that needs to be challenged. The Transparency Task Force are doing just that!”

Dr Colin Lawrence,

NED &Chair, Risk and Compliance, OSTC Ltd; Ex Senior Regulator, Bank of England

“The setting up of the Transparency Task Force is a significant milestone to ensure that the UK maintains the highest risk and governance standards; Andy Agathangelou has done a remarkable job in integrating leading professionals who walk the walk.

Failure in risk standards has horrific consequences on customers, jobs and financial stability.

The Transparency Task Force is a great way to ensure eyes are not taken off the ball.”

Edd Twohig,

“TTF has thankfully expanded from it’s UK base to assist many in other jurisdictions who face similar problems. TTF is a window to far more than the universal problems of customers dealing with the financial sector. My research into what is wrong with Canadian taxation, monetary and economic policy has been enhanced by listening to and discussing common interests with those of other countries. TTF goes much farther than forums dedicated to narrower interests. The successes of TTF in the UK could reach other countries if many more could expand their horizons through TTF.”

Eoin Murray,

Head of Investments, Hermes Investments

“The deepest question that we must all wrestle with is whether it is reasonable to assume that the very system and ways of doing things that got us into our current planetary predicament is the one that we should rely on to extricate ourselves. The greatest service that the Transparency Task Force provides is an answer to at least part of that fundamental problem – the desire for a financial services sector that serves the end customer and society better is truly welcome and a genuine breath of fresh air.”

Faizan Farid,

Acting Relationship Manager, St. George Bank

“As a banker for more than 8 years I would like to highlight the point that despite a whole lot of people doing the right thing, the banking industry keeps on facing challenges in terms of its image every now and then. This situation is very unfortunate and alarming for the general public including myself who is the end consumer of the banking products at the same time.

Transparency Task Force (TTF) is a platform where we as a consumer highlight the actions and policies of the financial sectors which are not aligned with the best interest of the end consumers. As a banker we have a fiduciary responsibility to the general public and we have to do our bit to make sure that the finance sector as a whole remains accountable for the trust people have in it. TTF provides that missing link with the aim to reform the financial sector for the betterment of the broader society and everyone’s input is welcomed. Let’s do our bit for the future generations and I would like to thank you for your support.”

George Kinder,

President & Founder

The Kinder Institute of Life Planning

“I love the Transparency Task Force. Everything they do is extraordinary, and connected. I don’t know Andy personally, but I’ve spent some time with him at his conferences, and watched him develop his brand, and I couldn’t be more impressed with who he is or what he does. If the industry was following along, our world would be an incredible place. If I had more time, I would be much more engaged with him, and supporting his work. He has a wonderful way of encouraging all of us, and the best in the industry, to participate in crafting approaches to the industry that have honor, ethics and humanity in them.”

Awaiting photo

Graham Forest-Jones,

Business Consultant, Business Owner and Business Developer, GFJ Publishing

“Our society in the UK has developed an extremely sophisticated and complex Financial Services business since the seventeenth century; it has been respected worldwide since its inception and has had at its heart the philosophy of trust and legal safeguard.

Imagine then when this trust is seen to be abused, exploited and manipulated for personal financial gain by highly qualified, senior individuals within the industry, who do not share the core values on which our systems were based. The philosophy of our industry, our nation and our political systems becomes open to criticism; our brand as a trusted first world nation becomes tarred with the actions of a small number of individuals.

The Transparency Task Force is an example of the desire of senior individuals in the finance sector to provide an extra layer of scrutiny and independent review of all financial dealings at any level, which encourages review of individuals, and, in a few cases, teams, that need to be called into question. It is an inspiration to those of us who believe in doing the right thing. Whistle-blowing is the most powerful tool against corruption and selfish gain. Let’s all act now and support the TTF to put an end to all corruption in our financial services sector.”

Harinder Mann,

Professor of Strategy and Innovation, Ashridge Business School

“The Transparency Task Force has been a driving force for good in the industry since its inception. Andy and the team have worked tirelessly to bring the voice of the consumer to the policy making table to be heard on the issues that matter. That’s an important voice which matters as it helps build an industry that is driven by the needs of the consumer and in acting in their best interests. The work of TTF in exposing the pension scams is an example of this. The TTF team has led the debate for the thousand of consumers by documenting and getting across the issues that matter. Long may that voice continue.”

Helen Scott,

CEO, Eris FX

“As the CEO of a financial services business struggling to do the right thing for consumers, I cannot speak highly enough of the Transparency Task Force and particularly Andy Agathangelou. The sheer breadth and depth of the sectors and topics tackled would be astonishing for any well-funded large organisation, but it is all the more remarkable when you consider that Andy is doing much of this in his own time and on an absolute shoestring.

Andy’s honesty and passion is palpable in his tireless drive to do the right thing, a rare quality in the financial services sector. He succeeds where many have failed, delivering a steady, rational, persistent message with warmth, humanity, courage, a sense of humour and, above all, utter and unwavering politeness. TTF is an absolute winning formula. It is firmly on the side of the little people against the unacceptable face of financial services. It is tackling the issues that matter to them and affect them. TTF not only deserves some proper recognition, but also some proper public funding. Andy deserves a knighthood.£

Hillard MacBeth,

Portfolio Manager/Author, Richardson GMP Limited

“The Transparency Task Force is working for a very good cause. The banking sector occupies a very important position in society, as commercial banks have to power to create money out of thin air. This power can be abused, and often is. Credit creation can and should be used for productive purposes but, more and more, bank lending is focused on loans for property investment and speculation.

In the 2007 Global Financial Crisis most banks in the world were caught with an excess of bad loans, and every large bank in England, except one, had to be rescued. This financial fiasco was a direct result of banks granting too much credit for speculative purposes. Regulators seem unable to see the crises in advance and have had no impact in moderating the boom and bust economic cycle. As the Queen asked during a visit to the London School of Economics, “Why did no one see it coming?”

The TTF plays the important role that others cannot or will not, in pointing out innate weaknesses in the financial system. This role is essential if we are to avoid the immense damage that could be caused by the next credit crunch.”

Ian Tyler,

Senior Advisor, Alvarez and Marsal

“The Transparency Task Force has effectively shone a light into some of the darker corners of UK financial services and has given those badly impacted by fraud or serious misconduct the opportunity to highlight both the initial injustice but also in many cases the ongoing failure by UK regulators and other statutory bodies to take effective action either to punish the miscreants or remediate those adversely impacted.

Given the limited resources available to TTF the impact that Andy and his team have made is remarkable and I would encourage all people of goodwill to support TTF through making a regular financial donation (however modest) and/or if you have the requisite skills and experience offering support to one of the initiatives on a pro bono basis.”

Ian Neale,

Director, Aries Pension & Insurance Systema Ltd

“TTF is on a vital mission to expose the systemic cultural malaise which has infected the global financial services sector over the past forty years. Fraud at all levels, accompanied by serial regulatory failure to detect and neutralise perpetrators, has severely damaged public confidence. TTF is demonstrating the persistence required to counter efforts by regulators and politicians to pass off scandals as the fault of a few ‘bad apples’. Corporate sponsorship of politicians and political parties, aided and abetted by revolving doors between government and industry, has engendered a culture in which regulatory penalties for breaches of compliance are a cost of doing business. Worse still, these costs are passed on to clients, eventually rendering beneficial participation in saving for the future nugatory. The ‘force’ in TTF has the potential to trigger a paradigm shift in the finance industry, so that its purpose is transformed from prey and plunder to serve and sustain.”

Ian Beestin,

Co-Founder, Money Alive

“I am not sure who first said “It is better to light a candle than to complain about the dark” but for me it sums up perfectly what the Transparency Task Force is all about. Andy and his team have brought together a community of like minded people with different backgrounds, experiences and talents to help shine a light on the financial sector and to lobby to make it work better for consumers.

I have learned a great deal from listening to the excellent speakers who take part in the organisation’s regular events and have enjoyed working, as part of a team, to help the TTF think and respond to the numerous consultations there have been during my time as a member. The organisation’s political influence continues to grow and it is great to see talk turning into actions leading to positive change for consumers. The candle is burning and getting stronger and stronger.”

Awaiting photo

Isabella Wesoly,

Director, Making Murals Ltd

“In a world where deception and fraud are cloaked in convincing acts, without any recourse, it is nigh time that action is taken for both the victims of injustice and for the integrity of genuine financial conduct.”

Jacqueline Hill,

Leadership Coach & Change Mentor, J Hill Associates

“I am a leadership coach and change mentor, practicing kind activism to change the way we look at and value the world we live in. The TTF community contributes to changing a sector that influences every individual, and one which facilitates our collective impact upon the planet. TTF aims to help refocus the culture of the finance sector towards serving the needs of customers, towards being guardians rather than exploiters of our common wealth. It does this through working with individuals within the sector, and those who govern it, to motivate them to take responsibility for both the intended and unintended consequences of their actions, and to rectify harm. As I am not a finance expert, TTF provides me with a voice and an opportunity to use my skills and network in a common cause. It is great to belong to this exciting, friendly and values-driven group.”

Awaiting photo

Jaiprakash Sharma,

Chairman, Global Research Foundation for Corporate Governance (GRFCG)

“I got associated with the Transparency Task Force only last year as an Ambassador and during this period I have noticed that you are continuously doing a great job for the society. Your level of quality work remains unparalleled. I believe the work you are doing will bring happiness to many people in the future. I hope that you continue to perform in the same style and enthusiasm. May you reach every height of success”.

James Markham,

Managing Director, SBC Systems

“The Transparency Task Force’s mission of promoting ongoing reform of the financial services sector provides a vital service to society. The TTF has brought together a wide variety of interested parties from around the UK and across the world. The Founder’s (Andy Agathangelou) personal energy in building and progressing this Taskforce is impressive. I personally have been engaged with Andy in connection with this and similar efforts for many years. I am pleased to endorse the Task Force’s vision of building a highly respected, influential and international institution that is dedicated to helping ensure consumers are treated fairly by the finance sector.”

Jan Floyd-Douglas,

Director & Co-Founder, The 9 Situations

“Having worked within the banking and financial services sectors for over 25 years, the aims of the TTF totally reflect my own in that wholesale reform of these sectors is required to prevent and repair the horrendous impact on society of financial scams and fraud. In addition, Andy Agathangelou and his team are to be applauded for also shining a spotlight on the cosy relationship the UK regulators appear to have with some of those they are charged with regulating. It is little wonder that the UK has the shameful reputation as being one of the global hotspots for financial fraud and crime when it is so unsuccessful in bringing criminals to justice. TTF are to be congratulated on the huge progress they have made so far with government policy makers, MPs and financial crime victim groups, amongst others. I am honoured to be a TTF Ambassador.”

Janice Sengupta,

External Ratings Committee Member, Adviser Ratings

“TTF has provided me with insight on concrete ways financial services can be improved to enhance fairness for people. Bringing together practitioners with diverse perspectives but with a shared interest in improving society shines a light on fruitful changes that can be made at the level of policy and in the provision of financial services.”

Jason Hsu,

Founder, Rayliant Global Advisors

“The Transparency Task Force and what it stands for give me faith in the future of our industry. The financial service sector is both important and unique. Clients expect us to be fiduciaries; service providers market themselves as fiduciaries who put clients first; the reality has been anything but that. The lack of transparency in values provided and fees charged and the prevalence of aspirational marketing glib which service providers often have no intention of fully honoring—have led systematically to great wealth for the financial institutions and poor outcome for the people they serve.

Given the significance of financial services to long-term household wealth formation, the sector cannot be left entirely to its own devices expecting that corporate profit maximization would magically lead to a fair outcome for consumers. We need champions for the consumers to be at the table with regulators to push for better governance and reform for the industry—to rebalance the ecosystem in favor of the investor. Transparency Task Force is that champion we sorely need.”

Jefferson Braswell,

Chair, Board of Governors, ACTUS Financial Research Foundation

“With the extensive network of professional contacts and the focused leadership of Andy Agathangelou, the Transparency Task Force has been actively conducting collaborative discussions and seminars with financial system organizations and stakeholders with the important goal to promote efficiencies, open standards, fairness and the public good in the activities and conduct of participants in the global financial system.”

Jeff Gitterman,

Co-Founding Partner, Gitterman Wealth Management, LLC

“I joined TTF because I believe capital can be a force for good and is necessary to achieve the SDG goals set out by the UN. But without trust and transparency brought to financial institutions we won’t be able to steward capital towards the solving of our global problems like climate change and social justice. The financial industry has a chance to lead here and TTF can help chart that course.”

Awaiting photo

Jeremy Conford,

Financial Adviser, IFA

“I think the work that the Transparency Task Force, Andy Agathangelou and all the others involved in shedding light on the govt and financial services industry`s failings in dealing with financial crime and scams and in particular the treatment of the victims of these crimes by HMRC and the govt system and regulators is compelling and so admiral, they deserve all the amount of support, financial and otherwise, they can get.”

Joanne Rossouw,

Barclays Bank Whistleblower

“I joined the Transparency Task Force (TTF) in 2020. I have attended several TTF symposia where I have heard credible evidence given by victims and other stakeholders, highlighting a systemic culture of dishonesty and deceit within our finance sector. It is apparent that rogue culture comes from the top. However, it permeates throughout, eroding the values and the standards within the sector and overspilling into the economy and society. Our regulators are fully aware yet seem to be ‘asleep at the wheel’. Or are they accomplices of those they fail to regulate and thus act against the interests of the very consumers they are tasked to protect?

The TTF has over the years been doing really good work in reaching out to victims and other stakeholders concerned by the decades of ongoing rogue conduct in the finance sector. By exposing and calling out wrongdoings, offenders, and recidivism, the TTF can highlight the offenders who continue in a pattern of unabated wrongdoing dragging standards and trust down. By shining a light on this, TTF are raising awareness of the need for greater transparency, accountability, and effective measures, to drive change and properly safeguard the sector, the economy and society.

I believe that TTF is living up to its vision and growing an increasingly effective platform where victims are speaking out loudly and clearly so that our finance sector may become a shining example of an honest, responsible sector that can be trusted in everything it does. TTF has over the months gained my confidence in the democratic power of ordinary, honest people drawn together effectively to achieve mutually TTF’s vision: “To build a highly respected, influential and international institution that is dedicated to helping ensure consumers are treated fairly by the finance sector”.”

John Guidi

“The Transparency Task Force has, since my introduction to it, been a source of excellent information with contributions across an exceptionally wide variety of topics all linked by a common theme; the workings of financial services in our lives and how to make this vital function work better. No subject matter is beyond discussion or debate, no investigation or symposium has any strings attached. Its aim is clear – to provide an honest platform for public scrutiny and discussion as a means to study the workings of financial services and to provide solutions where possible for wrongs to be identified and put right. That it does this in a scholarly and entertaining way is testament to the professionalism of this organisation.”

Josef Pilger,

Global Pension & Retirement Leader, EY

“Financial services providers make a big difference in building better financial wellbeing outcomes. It’s a journey that requires consistent refinements but the customers are key. TTF plays a pivotal bridge between both and a reminder to focus on outcomes.”

Jyoti Guptara,

Speaker/Author/Storytelling Consultant

“In the era of Wall Street Bets and Bitcoin, the work of the Transparency Task Force is as important as it is urgent. Low transparency and trustworthiness hurt us all. Regulation alone can and does easily backfire. If only there were a community of experts to tackle the problem and a holistic roadmap to follow . . . Look no further! I’m grateful to be part of such a community here, and urge every financial institution to engage with the work of the TTF.”

Kara Tan Bhala,

President and Founder, Seven Pillars Institute for Global Finance and Ethics

“Philip K. Dick, who wrote inventive, page-turning science fiction, penned an alternate history novel titled, The Man in the High Castle. In the book, he drew an alternate world in which Guiseppe Zangara had assassinated Franklin D. Roosevelt in 1933: The Great Depression continues, Nazi Germany and Imperial Japan conquer most of the world, and proceeding developments become disturbingly dystopian.

In a similar vein, an alternate world in which the Transparency Task Force does not exist is one that suffers a considerable loss of the Good. There would be no meetings with Members of Parliament to highlight and motivate reform in financial services, no enlightening the public to the many damaging financial scandals, no setting up of global working groups to improve how we practice finance. No entity would coalesce disparate groups and individuals who desire enhanced transparency and integrity in finance. No institution would provide a platform and impetus for collaboration among multiple agents with a single purpose: to bring about a financial services sector that better serves consumers. No body would push with passion to change financial institutions, so they treat customers fairly, in accord with their human dignity. In sum, without the TTF, financial services reformers would experience less coalescing, less collaboration and therefore, less good change in finance. Thankfully, in this reality, we do have to our benefit, the Transparency Task Force.”

Kate Upcraft,

Director, Kate Upcraft Consultancy

“I’m really an interloper in the pensions word as my specialism is employment tax, but in 2012 the world of pensions crashed headlong into employer payroll responsibilities and I was lucky enough to attend the PLSA conference (NAPF as it was then) to speak about what our role would be in the heavy lifting of auto-enrolment. There I met Andy Agathangelou, and could see at once he was a passionate advocate for pensions as a force for good.

Over the years I have seen that passion, and a consummate ability to bring thought leaders to together for a common cause, turn the TTF into a force to be reckoned with by those with the power to make a difference to people whose finances have been impacted by an opaque financial services sector and at the worst have had their whole lives blighted by scammers taking advantage of the same outdated rules with regulators that aren’t fit for the 21st century. The UK needs the TTF, more than ever given the exponential rise of those being preyed upon during the pandemic. May their work mean that one day they may not be needed as their job is done, sadly I don’t think that will be any time soon!”

Kay Ingram,

Director of Public Policy, LEBC Group

“The Transparency Task Force is doing a superb job in encouraging best practice in financial services which is open, transparent and puts consumers at the heart of its mission statement. Starting from small beginnings TTF has grown in support and influence, encouraging financial services market participants, regulators, journalists and politicians to work together to achieve a better financial services environment in which people can save and invest with confidence.”

Ken Kivenko,

President, Kenmar Associates

“There are many common challenges facing the retail investor regardless of the regulatory jurisdiction. Its advocacy initiatives provide an important voice for Main Street investors.”

Kim Schweitzer

“I’m honoured to serve as an Ambassador and Volunteer of the Transparency Task Force (TTF). Andy Agathangelou and the TTF community inspire action and immediacy to challenge financial services to rebuild trust and confidence. This is undeniably a daunting goal, but one that Andy and a dedicated group of staff, ambassadors, volunteers, members, contributors and supporters are passionate about, as they recognise the importance it has on society.

TTF creates an agenda to support society as a whole by successfully engaging with decision-makers and influencers who can help can change the rhetoric. From tackling a broad range of ESG challenges, to helping vulnerable victims of financial crime, whistleblowers, and others caught up in a system where putting profits over purpose has, at times, clouded good judgement and ethics.

As Founder of Time 4 Change London, I feel very strongly that my values are closely aligned with TTF, because they work every day to drive positive, progressive and purposeful financial reform to serve society better. Through my involvement with TTF, I believe that both my personal and professional goals are being fulfilled, as I am working as a force for social, moral and economic change.

It humbles me to be a part of the TTF community and experience the compassion, integrity and bravery that the team exhibits in taking on these challenges. The Transparency Task Force is an organisation that is authentically living its purpose and values each and every day, and truly making a difference in a positive, impactful way!”

Krzysztof Grabowski,

Capital Markets and Corporate Governance Expert, Retired

“I have decided to become a member and ambassador of the Transparency Task Force, because it is a unique global forum where you can discuss freely all the issues that add together to the wide spectrum of ideas and practical solutions necessary to the development of the global financial services sector, transparent and reliable. You can meet there people from all parts of the world and this way you may learn what are the specific problems arising from different cultures and traditions. Only when you really understand those differences you begin to see several similarities, and this way you may find universal solutions for ongoing reform of the financial services sector. This is a good way in which the trust can be built and developed between business and consumers, between consumers and regulators, between regulators and business.”

Lars Hass,

Professor of Accounting and Finance, Universoty of Strathclyde

“TTF has the potential to be an important force in helping to ensure that the financial services sector serves society better. I fully support its mission to provide a reliable and accessible source of information for violations of laws and regulations. This is an important step in ensuring accountability for companies. I am looking forward to using this source in my research.”

Laurence Wormald,

Head of Applied Research, SAPIAT

“I have been involved with TTF for three years now, and I have personally observed how it has grown and matured into a most effective institution whose work is accelerating the reform of the financial services sector internationally. TTF has succeeded in moving from critique to action, by taking a global perspective on the deep causes of financial misconduct, and by collaborating with other campaigning groups on specific issues such as UK regulatory failures. I believe TTF’s energetic and well-researched approach to the investigation of UK financial scandals, and its willingness to engage with industry experts as well as victims while contributing to the work of parliamentary committees, represents the best hope for the necessary reform within the UK.

Meanwhile, the organisation is generating and propagating many useful and novel ideas, via TTF’s book publication, public seminars and other content. These suggestions for how to improve our approaches to risk management, and more broadly to foster an ethical culture within finance, are essential for the future development of a more socially-useful banking, investment and retirement planning sector.”

Awaiting photo

Lesley Bracher,

“Most people are aware of financial scandals involving banking and investments where the FCA have failed in their duty of care in ensuring that the products on offer meet the standards expected and ensure that consumers are treated fairly. When these products fail the FCA and other interested parties bury their heads in the sand and absolve themselves of any responsibility. My husband and I know to our cost when we naively invested some of our savings in Blackmore Bonds. The FCA were warned many times of wrongful selling of these bonds several years ago but these were ignored and because they failed to act many more investors lost their money.

Through Facebook groups we have been introduced to TTF and it is very obvious that the people there are giving their valuable time in their determination to improve the financial sector and it’s reputation. TTF is a highly regarded organisation. So much so that it is able to gather like minded influential speakers with the same aim of making the banking and financial services of the United Kingdom one of the most highly respected in the world where consumers are treated fairly.”

Lesley Curwen,

“I discovered the Transparency Task Force in 2016, when Andy spoke at a meeting I went to. It was a revelation. As a personal finance and business reporter for the BBC, I had spent a long career reporting on financial scandals and interviewing victims who would never again trust the sector. Scandals such as the Maxwell pension heist, Enron, Equitable Life, UK pension mis-selling (several waves of this) split capital investment trusts, PPI, the Libor and Forex scandals – I could go on, but let’s stop there. Often I had interviewed the regulators or ministers about the scandal in question, reaping more promises that this time they would get to grips with the problem, to better protect consumers in future. Broadly speaking, in my view, it never happened. I believe that consumers are now more vulnerable than ever to a tsunami of investment fraud, perpetrated online, which regulators have completely failed to control.

We need the strength and reach of the TTF, which has grown so much over recent years, to battle on behalf of the consumer and on behalf of the many responsible and caring members of the financial industry who want to act fairly, and improve the sector’s reputation. The TTF is a voice which is unique, in that it seeks to work with industry and regulators, bringing them together with the victims of the worst financial scams to hear the continuing human cost of what happens. And it has taken its perspective into the law-making arena, through assisting All Party Parliamentary Groups which address these problems. The existence of the TTF stops me from despairing about the lack of protection for our families when they make financial decisions. Please support it.”

Lynne Coombes

“The mission statement for the Transparency Taskforce, a Social Enterprise, is a powerful on “to promote ongoing reform of the financial services sector so that it serves society better”. It is made even more powerful by the fact that it is the very driving force behind TTF. I have been involved for a year now and am an ambassador and volunteer. I have attended many seminars and meetings that have really made progress by discussing difficult issues with right minded people from around the world – to sum up from the TTF website – “people that want to stand up rather than stand by”.

Two All Party Parliamentary Groups have already been formed with others hopefully coming to fruition – a certain way of ensuring difficult subjects are widely discussed with real hope for change in the future. I am a subscription member that gives me access to meetings, seminars and discussion groups that will also allow me to be a part of future change. The subscription model is very flexible and a member is able to pay what they can afford. I am proud and excited to be a small part of such a forward thinking group of people from all walks of professional life that, by banding together, are really making a difference.”

Maite Ibarretxe

“The purpose of this statement is to express appreciation for the great work of the Transparency Taskforce to drive the ongoing reform of the financial services sector to better serve society. Its vision to rebuild a highly respectable financial sector, is at the heart of the new economic model that the world demands.

Today’s global challenges, such as climate change or inequalities, have much deeper causes that largely stem from the current economic system. The Transparency Task Force orchestrates actors in the financial systems who are in a unique position to take steps together to transform the sector towards a new economic model.

The diversity of activities, the qualified experts speaking in their symposia and the very involved, professional and passionate staff, members and volunteers are decisive for the success of TTF.”

Marcos Eguiguren

“The Transparency Task Force is playing a crucial role in promoting ongoing reform of the financial services sector but, what is more important, it is becoming also a catalyst for deep reflection amongst leaders in the financial industry.

Regulation and prudential supervision is only a way to look at reform and to help ensure consumers of financial services are treated fairly. However, thinking with a long-term approach, what is more relevant is that companies in the industry, their investors, their board members, their CEOs and other executives, become truly and deeply engaged with human values and that are able to make of ethics and the respect for human dignity and fairness the central pillar of their activities and the core of their decision-making processes.

The Transparency Task Force is also playing a role in that field by becoming a convening centre and a think tank for those leaders that have the aspiration to deeply change the essence of the industry from within. I’m proud of being myself a founding member of the International League of Ethical Financial Leaders, initiated by The Transparency Task Force.”

Margaret Hayward

“TTF is an incredible organization doing ground-breaking work in challenging corruption and other such nefarious activities by forcing up transparency levels in the financial services and other related sectors. With the help of TTF’s collective insight, expertise and political will, it is exposing the existing culture of secrecy and thinly disguised self-regulation that so many institutions have so far hidden behind. TTF also seems to have attracted a large membership of knowledgeable and eminent persons who have had either direct or indirect experience via whistleblowers and other such victims of these abuses. The irony is that these violations are often supported and indeed tolerated by the legal profession in its totality — contrary to its international and misguided reputation! My family has personally suffered at the hands of the banks and other semi-government agencies and we are grateful for such a credible movement that the TTF is creating to better serve and protect the public.”

Maria Kapardis

“The diverse thematic areas as well as the multinational and interdisciplinary events organized by the Transparency Task Force make the events organized by the group interesting and worthwhile. The discussions following the seminars are very stimulating and raise many issues that affect most of the people around the globe.

In the short time that the Taskforce has been in operation has been consistent in promoting its mission which “ is to promote ongoing reform of the financial services sector, so that it serves society better “and it is fulfilling its vision which “is to build a highly respected, influential and international institution that is dedicated to helping ensure consumers are treated fairly by the finance sector”. I met Andy Agathagelou at an OECD Forum in Paris a few years ago and I was inspired by his passion to address so many diverse and important topics, the passion and enthusiasm has grown and has embraced a bigger community around the world. Congratulations to the TT team.“

Mark Bishop

“I became involved with TTF around a year ago, having spent eight years campaigning for redress for the victims of the Connaught consumer investment fraud, and for reform of the FCA to prevent further such cases happening. What attracted me to the organisation is that it brings together the expertise of three groups: the honest guys in the industry, others impacted by regulatory failure and whistleblowers. What’s more, their experiences span multiple jurisdictions, making it possible to identify good practice in one country and argue for its implementation in another.

The financial services industry contains some powerful incumbents that understandably resist change. Imposing it on them requires campaigners to demonstrate systemic failure, backed up with extensive evidence and well reasoned proposals for improving regulation, and thereby behaviour and hence outcomes. This can happen only when there is a critical mass of expertise clustered within one organisation. The Transparency Task Force has become that entity. It is the conduit through which much needed change will happen. ”

Mark Turner

“One thing that makes the TTF special is the diversity of contributors and supporters – I can think of no other body that brings together industry leaders, academics, consultants, politicians, and importantly, members of the public. Everyone involved with the TTF can speak freely and honestly, with the TTF providing a safe space for all. I have been involved in fascinating discussions across this diverse group, and always come away from TTF meetings having learnt something.

I am delighted to support the Transparency Task Force. The financial services industry, like any other industry, exists to serve its customers. The vast majority of individuals working in our industry act with honesty, integrity and transparency. However there are still too many stories where this is not the case, despite the best efforts of management and the regulators. More needs to be done, and the TTF has become a real force for positive change.”

Mark Hambling,

“I have been involved in the TTF for about 5 months now and have been astonished, shocked and dismayed in equal measure as to the extent of the apparent ineptitude of the Regulatory Authorities. I fully support and endorse their views on what we, as consumers, should reasonably expect of our regulators and will continue to work with them to raise awareness with lawmakers and other parties to argue for the changes that are so badly needed.”

Martyn Cuff,

CFO/COO, Square Mile Investment Consulting and Research Limited

“A healthy, disciplined, and well-functioning financial services industry is central to building a strong society. This places responsibilities upon every organisation and individual operating with the sector to ensure that they adhere to the highest levels of professionalism. TTF has an admirable passion for customers to receive a fair deal. Through their efforts they are helping to keep the spotlight on the behaviour of financial services firms. In turn, this brings benefits to customers and wider society.

Neil Taylor,

Retired Group Finance Director – Automotive Distributors Ltd

“Having been in finance for 30 years, and having on many times wondered what I should be doing in retirement, I have found a calling. Having recently been the victim of three scandals, I decided to research matters.

I cannot believe how the financial markets are allowed to operate in such an unfettered and uncontrolled way, without proper regulation. I do believe the support of the Transparency Task Force, a shining beacon of light with a dedicated group of individuals led by Andy Agathangelou, will be instrumental in changing the pathway for investors and consumers in the future.

I have recently offered my support to Andy Agathangelou, who seems tireless, and the most energetic and enthusiastic guy to make the world a better place for investors; who have clearly been let down by the services from “dodgy cowboy operators” that now seem so pervasive in our financial market.”

Noha Al Afifi,

“I joined the Transparency Task Force because I am passionate about the work that it does – which is to promote fairer and more transparent practices across the finance sector for the benefit of society and communities everywhere. I continue to be impressed by the wide impact of the Task Force despite resource and staffing constraints. It goes to show that a real focus on real world issues, and bringing like-minded people together who are truly passionate about the cause, can achieve the greatest of things.

Paul Bates,

“The TTF has been an inspiration – an opportunity to hear real accounts of financial malpractice from those detrimentally affected, which inspires the desire to better serve just causes in judicial claims for address. An experience in learning from sophisticated and knowledgeable persons with the experience of finance, which inspires and rewards with increased understanding and insight into the finance industry. Most of all, inspiration from collaborating with dedicated and talented colleagues who see a path ahead to improving financial services in many countries around the globe…”

Shane Norman,

Consultant, Business Development for Fund Managers

“The question is not: Why should you support the Transparency Task Force? Rather, as a user of financial services like all of us, you should ask: Why not?

Why do you not want a better financial services industry, not just in the UK, but in every nation? Why do you not want to trust providers to look after your money and your interests honestly, accountably, and transparently? Why do you not want fault or error to be promptly and openly admitted, along with apologies and, where appropriate, compensation?

In short, why do you not want providers to recognise they are dealing with YOUR money – and act accordingly?

That is what the Transparency Task Force aims to achieve. That is why I am proud to be a subscription member and a UK Ambassador.”

Sue Flood,

Founder, The Ark Pension Scam Victims Support Group

“As a victim of financial fraud/crime, I welcome the humongous efforts that Andy and the members of the The Transparency Task Force are doing to improve how the financial industry and “regulators” operate.

The TTF have an enormous uphill struggle to overcome the gaps in both the legislative and regulatory regimes which currently prevail which still favours unscrupulous individuals to target victims. However with the vast knowledge, experience and skills now gathered together, the TTF members can be the leading voice of reason offering pragmatic solutions to help ensure an open and transparent financial system that works safely for all.”

William Price,

CEO, D3P Global

“The Transparency Task Force makes a vital contribution to improving financial markets for consumers and I am proud to support it. Andy and the team have worked tirelessly to create a global network of people who think that financial services can and must do a better job in delivering outcomes that matter for individuals. The Task force is delivering a track record of influence and change that deserves all our support – to ensure that a better deal for people is something that is always achieved, not something that has to be fought for.”

Erinch Sahan,

Business Lead, Doughnut Economics Action Lab

“Transforming our financial system is at the heart of achieving an economy that meets the needs of all people within the boundaries of our livingplanet. For this reason, I am delighted to see the critical work that the Transparency Task Force is doing in drawing attention to the great transformations needed in finance”

John Martin,

Founder and CEO, Plutus Consulting Group

“As a member and volunteer of TTF, my aim is to help make a difference by influencing the ‘behaviours’ of organisations, people and leaders in the Financial Services Sector.

A professional with 30+ years’ experience, I bring expertise, understanding and thought leadership to challenging the historical ways of working, whilst embracing innovation and sometimes disruptive, collaborative ideas.

Recent financial crises, multiple fines, and covid-19 have highlighted the need for the banking sector to embrace its weaknesses and fundamentally change its way of doing business – restoring trust will require a paradigm shift in thinking.

Fixing the banking system and making regulators more accountable, is crucial to meeting the expectations of consumers, shareholders and investors that are demanding greater transparency and responsibility of both corporate and individual actions.”

Juan Carlos Venegas,

Forensic Accountant, FA Forensics Ltd

“Why do I support Transparency Task Force? Put simply, I can summarise it in three words: transparency, honesty and integrity. The key principles that should govern any financial institution, and financial services in general.

Despite the fact that I have not been a victim of any scam or misconduct of any financial institution, it does not mean that I have not an interest in transparency with the financial services. However, I have been aware first hand of misconduct within the financial services affecting businesses.

It is my belief that accountability is key when creating a corporate culture of integrity and transparency.